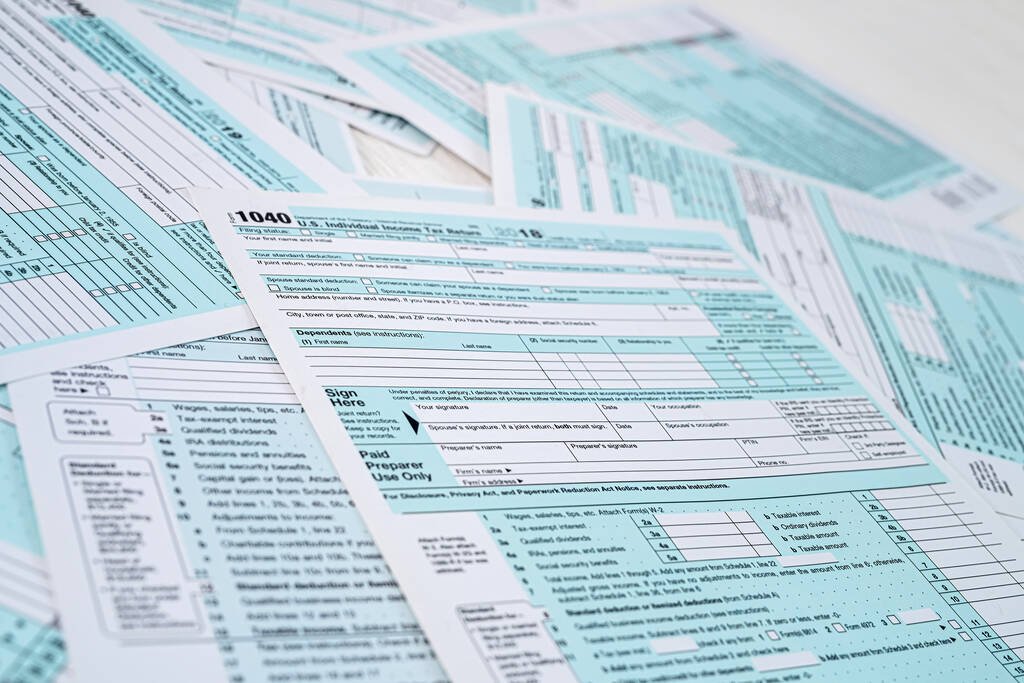

San Antonio’s Tax Advisor

We specialize in

Tax Preparation & Tax Planning

Proactive Strategy and Problem Solving

for S-Corps, LLCs, and High-Income Individuals in San Antonio

including all surrounding areas, will Texas Hill Country

Reach out to us now, we are extremely responsive.

IRS-licensed to advise taxpayers in all 50 states

-

Tax Preparation & Filing, IRS Problems

We specialize in tax returns encountered by high-income earners and families, often involving S-Corp tax returns, and LLCs. We can also help in case of any IRS problems.

Phone: + 1 (858) 779-4125

Email: Tax@S-CorpTax.com

OR -

Proactive Tax Planning, Personal and Business

Tax liability is not saved during the annual return period. That money is saved by optimizing throughout the year, applying state and federal tax rules with foresight.

Call or email us now!

We can usually discuss right away. -

Financial Strategy & Wealth Planning

Our CFA-managed Financial Strategy practice helps you make the most tax-efficient financial decisions. Implementing best practices now secures your future.

Call or email us. There are no costs.

We reply to all emails within an hour.

Your Year-Round Tax Support Team

Assisting High-Income Earners and Business Owners

Proactive Handling of all Tax Filing Obligations

Quarterly Tax Strategy and Optimization for High Earners

Clear and Simple Flat-Rate Pricing for each Tax Year

Personalized Service with a Dedicated Tax Specialist

Extremely Efficient Tax Return Preparation and Review, without Office Visits

Expertise in S-Corp and LLC Taxation, covering all Small Business Needs

Our Tax Specialists are Enrolled Agents… the highest IRS designation

As Enrolled Agents, we can handle any Tax Interaction directly with the IRS

If you get letters from the IRS, or owe them large amounts, we can help

We cover all of South Texas, including the San Antonio metro area

Write to Tax@S-CorpTax.com, or call (858) 779-4125.

We reply quickly and will be glad to speak through your situation, by phone or Zoom.

Put Your Tax Obligations on Auto-Pilot | Save Thousands Each Year

-

Efficient Tax Return Preparation

We specialize in complex returns affecting high-income earners, often also involving S-Corp tax returns, including LLCs that should be taxed as S-Corps. We service all of Texas.

-

Proactive Quarterly Tax Strategy

Taxes are not saved during the annual return preparation period. They are only saved by working way ahead of the filing deadlines, by applying the tax rules smartly and with foresight.

-

Financial Strategy & Wealth Planning

Our CFA-managed Financial Strategy practice helps you think through your financial decisions. Implementing our best practices make your retirement time well provided for.

Expert Tax Services for High-Income Earners, Business Owners, and Entrepreneurs

Navigating complex tax laws demands expert tax advisors. Whether you’re a high-income earner, small business owner, or entrepreneur, our certified tax professionals provide specialized tax services, including tax preparation, tax planning, and compliance for S-Corps, LLCs, and high-net-worth individuals.

Tailored Tax Strategies for Small Business Owners

Tax planning is critical for small business success. Our tax advisors offer comprehensive business tax services, from corporate tax preparation to strategic tax deductions. Whether you run an LLC, S-Corp, or large enterprise, we craft tax strategies to minimize tax liabilities, ensure compliance, and maximize profitability. Our proactive approach includes tax planning, risk management, and leveraging tax deductions to align with your business tax goals.

Trusted Tax Advisors for High-Income Earners

High-income earners face unique tax challenges, from income tax optimization to estate planning. Our experienced tax professionals specialize in tax services for high-net-worth individuals, offering tax-efficient strategies for investment tax planning, retirement tax planning, and asset protection. We ensure compliance with evolving tax laws while reducing your tax burden.

Comprehensive S-Corp and LLC Tax Services

S-Corps and LLCs require expert tax guidance to unlock tax benefits. Our S-Corp tax advisors and LLC tax specialists ensure compliance with federal tax regulations while maximizing tax savings. From quarterly tax filings to year-end tax planning, we provide actionable tax advice to support small business tax goals and long-term growth.

Tax Services Built on Trust and Accessibility

Unresponsive tax professionals frustrate business owners and high-income earners. We prioritize clear communication, offering an easy document upload system and responses within one business day. Our tax services are designed for transparency, building long-term partnerships with small business owners, entrepreneurs, and high-net-worth clients.

Maximizing Tax Efficiency and Growth

Searching for a tax advisor to navigate complex tax codes? Our team excels in business tax planning, S-Corp tax services, LLC tax strategies, and high-income tax solutions. We minimize tax liabilities and support wealth growth with personalized tax services tailored to your financial goals.

Contact us today to discover how our expert tax preparation, tax planning, and advisory services can optimize your small business or personal finances nationwide.

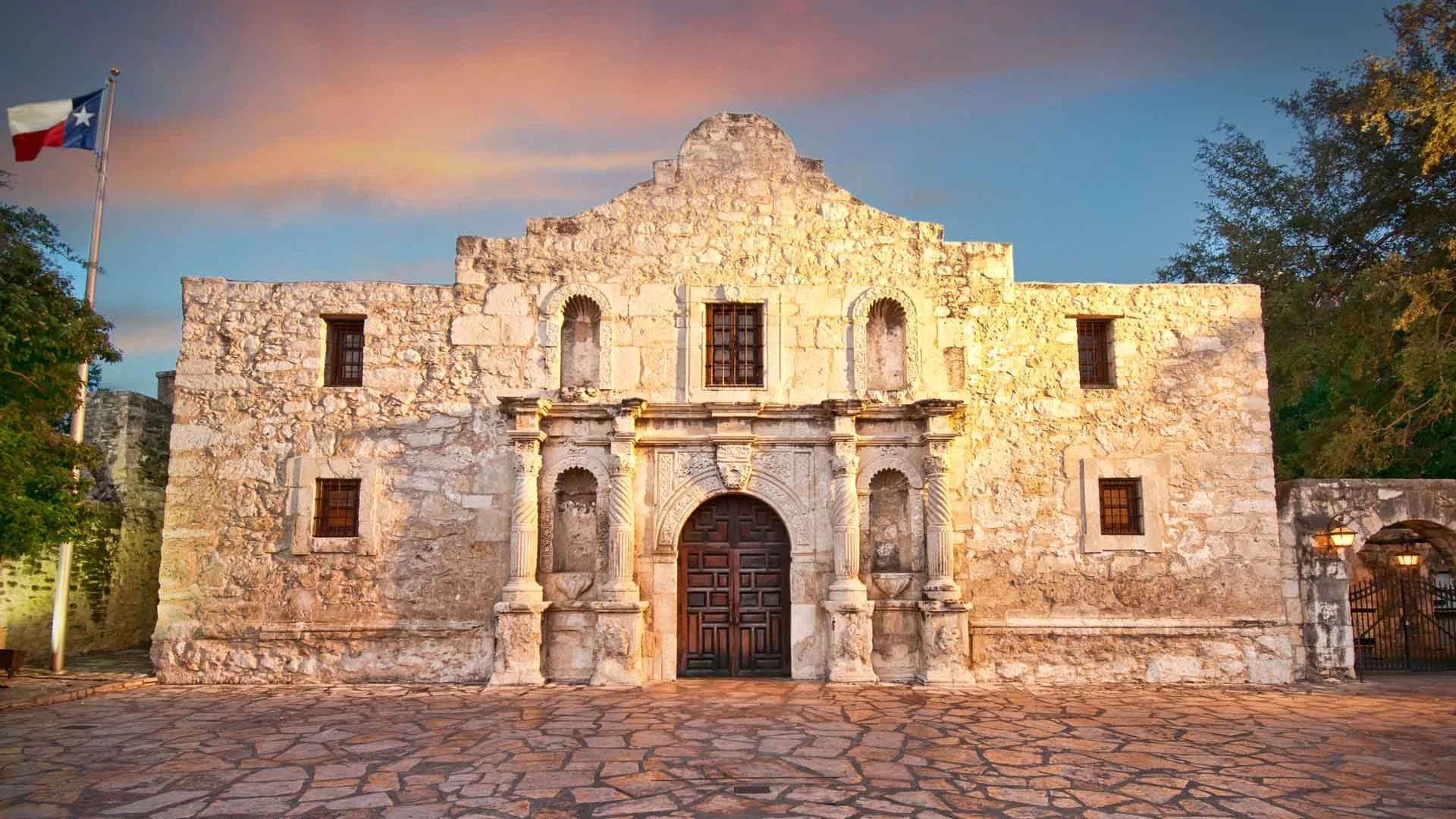

10250 John Saunders Road

San Antonio, TX 78246

Your Tax Advisor in San Antonio

Finding a reliable tax advisor in San Antonio has become more difficult in recent years. Many accounting firms have long waitlists, raise fees abruptly, or provide only impersonal service. For business owners and high-income individuals in South Texas, this lack of responsive tax expertise can create costly mistakes and missed opportunities.

Scorpio Tax Management offers a better option for San Antonio. We provide professional, attentive, and highly responsive tax services for entrepreneurs, investors, and successful families throughout Bexar County and the Hill Country. Our clients work directly with an experienced advisor—no hand-offs to junior staff, no confusing online portals, and no unanswered questions. Every tax matter is addressed promptly, with most client inquiries answered by the next business day.

📞 (858) 779-4125

📧 tax@S-CorpTax.com

In San Antonio’s diverse economy—ranging from healthcare and real estate to energy, military contracting, and small business enterprises—tax planning is never one-size-fits-all. High earners and entrepreneurs need a tax partner who not only prepares accurate returns but also creates strategies that minimize liabilities, maximize deductions, and protect long-term wealth.

Our expertise includes:

Business tax planning for S-Corps, partnerships, and LLCs

Personal tax services for high-income professionals and executives

Strategic planning for real estate investors and multi-state businesses

Ongoing tax advisory to ensure compliance with both federal and Texas-specific requirements

While we are widely recognized for our knowledge of S-Corporations, our practice extends well beyond. We work with high-net-worth individuals, growth-stage companies, and established enterprises across San Antonio and the surrounding Hill Country, helping clients simplify complexity and improve profitability.

For professionals, entrepreneurs, and families across San Antonio, working with the right tax advisor is not just about compliance—it is about building a trusted relationship that supports financial success year after year.